Can the Right Due Diligence Support Partner Maximize Your M&A Risk Assessments?

For every successful mega merger that generates billions in revenue, amplifies production, or reshapes the industry with its innovation, there are numerous M&A deals that fizzle or fall short of aspirations.

Most seasoned M&A experts would tell you that one contributing factor in realizing the full value of an acquisition is the degree to which you drill into understanding a target’s contract assets in the due diligence process. Yet many companies lack the resources to conduct a thorough review.

This has traditionally left companies with an “either/or” decision: deep dive into a fraction of your target’s contract portfolio or do a cursory run-through of the mountain of contractual relationships. At least, that was the cost-conscious choice enterprises needed to make before legal contract review merged with artificial intelligence. Today, in the wake of this technological upgrade, the ability to review contract prose at an accelerated rate and transform it into actionable reports can revolutionize your M&A strategies.

The Prized Data Your Contracts Convey

Legal professionals know that successful due diligence is dependent on detail-oriented analysis. Stakeholders reviewing the business operations, financial records, and commercial parameters of the deal need a keen eye to ensure everything is in proper order. A review of both active and expired contracts can reveal overlooked risks affecting the health and stability of organizations and potentially impact deal economics.

Here are a few of the possible questions that may be answered in the due diligence process:

- Are there non-assignable contracts which would prevent client accounts from transferring with the merger or acquisition?

- Are contracts set to terminate before or immediately after the planned acquisition?

- Are there contracts with high-legal risk, exposing you to potential litigation?

- Are customers not fulfilling minimum terms or obligations?

- Are there states or jurisdictions that the acquisition company does business in that are not on your radar?

Even archived contracts can tell a story—for example, if contracts have expired but suppliers are still on the active vendor list, you’ll be able to uncover this from auditing your legacy contracts. You can even identify instances of revenue leakage, which can help you to quickly recalibrate AR processes upon acquisition. These and other insights can help think beyond the acquisition into how to properly integrate the company within your business or sustain initiatives and projects through the transition.

How Our Contract Analysis Services Save Money & Time

Top attorneys are already looking out for these types of issues in contracts, but they are typically focused on legal concerns alone. Data quality and data relevance are usually not on their minds, though they play an equally important part of contract due diligence. In fact, they can prevent overvaluation, legal risks, and transactional risks down the road.

Robust contract analysis services can help with the data ingestion process during your due diligence. For example, Legalpeople uses an AI/ML-enhanced platform to streamline the process of deduplicating, culling, and organizing contract data based on the scope of your M&A review. Our algorithms remove any identical copies, but flag those that are similar for our team of legal review specialists to verify. This saves time while drastically reducing missed opportunities or red flags.

Moreover, a stable project management team can also accelerate deliverables. We maintain a dedicated in-house team of project managers, which has enabled us to fine-tune our methodology. Furthermore, this has helped to accelerate our ability to deliver actionable reports to your in-house counsel.

This service can also save time during the decision-making process. We think the transparency and clarity of the insights are as important as the contract reviews themselves. When your attorneys can quickly identify the key takeaways from contract data because reports are high quality and easy to review, your business can act faster to make competitive bids.

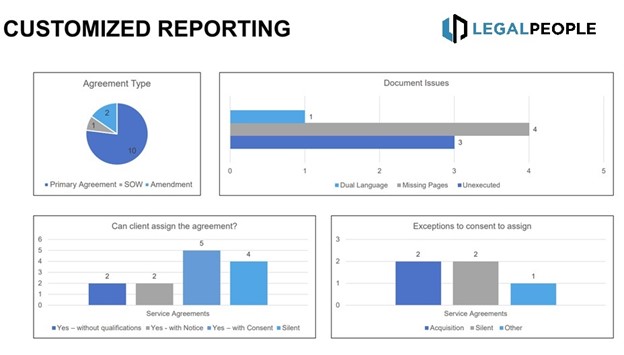

Here’s a sample of the type of information we can provide:

Additionally, the cost savings of using contract analysis services can be pivotal if you are evaluating multiple potential acquisitions. Depending on attorney seniority, law firms may charge you $200 to $500 per hour for legal due diligence reviews that often result in static memos that are filed away unread. CAS’s flexible pricing structure can provide pricing certainty and reduce the expenses related to M&A activity, allowing you to open up the scope and get more for your budget.

Now Is the Time to Use CAS for Contract Due Diligence

With an optimistic M&A environment on the horizon, your organization may face increased deal volumes in the coming quarters. However, if you can maximize your due diligence by reducing your costs and accelerating your time to insights, you can appropriately valuate businesses before others in your industry can. Though that might not translate to mega-merger results, it’ll go a long way to boosting the profitability and performance of your new and improved business.

Are you looking to improve your contract due diligence support? The Legalpeople team can help you to accelerate timelines and improve the quality of your valuations.

Related Articles

AI Contract Review Has Its Limits

CLM Integration: How to Maximize Your Legacy Contract Value

Energy Firm Modernizes Contract Analysis & Boosts Efficiency with Legalpeople